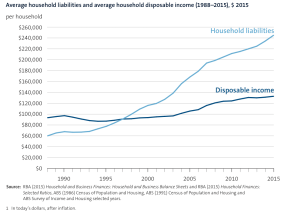

Over the last 30 years household debt has increased 400% while household disposable income has increased only 50% during the same period.

The great Australian dream is of owning your own home, but when are we going to pay off the debt. We get our dream home, but are left paying the home loan off over the next 30 years (if we are lucky).

The great Australian dream is of owning your own home, but when are we going to pay off the debt. We get our dream home, but are left paying the home loan off over the next 30 years (if we are lucky).

It may feel like we are never going to get in front, that we will never pay off the home loan and other debts….

Don’t give up all hope, we have options which can help us pay down the debt we owe. Here are my top 10 tips for paying off the home loan sooner.

Unfortunately, there is no silver bullet, it is going to take hard work and some determination. However, the payoff of finally being debt free is well worth the effort.

- Pay it off quickly – There are many strategies to reduce your loan, but most of them come down to one thing: Pay your loan off as fast as you can. Just increase your monthly payment by $50 and you are on the way.

- Pay more frequently – Most people are aware that if you pay your home loan fortnightly instead of monthly you can make a huge impact on repaying your loan. Simply divide your monthly payment in two and then pay fortnightly instead of monthly.

- Make payments at a higher interest rate amount – Ask your finance broker to work out what your repayments would be at 2% higher than the current rate and pay this off each month. The added bonus is if interest rates increase you won’t notice it.

- Consolidate your debts – Many lenders will allow you to consolidate all your high interest debt (credit cards, personal loans etc) into your home loan. The trick and biggest advantage of debt consolidation is to keep paying the regular payments you had prior to the refinance. And cut up those credit cards!

- Abandon those minor luxuries – If we cut out some small indulgences and put this towards the loan you are well on the road to paying off your loan sooner and saving bucket loads in interest payments. Let’s look at the example of how taking your lunch from home and having one less coffee per day will cut years and interest off your loan. If you spend about $12 per day on lunch and $4.50 twice a day on coffee, that’s $5,040 per year.

- Switch to a new loan or lender with a more suitable rate and package – Sometimes one of the simplest solutions for paying off your home loan sooner is to change your lender or loan structure. As the industry becomes more competitive, lenders change their products and offerings quite frequently. Unfortunately, your lender will be the last one to tell you they have a better or more competitive product.

- Use your offset account to your advantage – Instead of putting your spare cash into an interest bearing account where you earn very little interest and pay tax on the interest you earn, transfer any spare money you have into your offset account.

- Split your loan – Split loans allow you to fix part of your home loan and set the balance of the loan with the variable rate of interest. Essentially this allows you more flexibility knowing part of your loan is safely fixed and won’t move.

- Don’t be afraid of alternate lenders with cheaper rates – There are many second tier lenders who provide excellent products and rates competitive to the BIG 4. As the competition for business is at its all-time high, it makes lending a very interesting sector to be working in.

- Don’t set and forget – There is always the temptation to let your mortgage roll along, make your repayments as they fall due and think as little about it as possible. This attitude could be your biggest mistake. It is important to keep yourself up to date with the property and finance market. Rates change, new products are introduced and changes in the finance market itself may allow you to seize an opportunity or negotiate a better deal.

You don’t need to implement all of the tips, pick one or two to start with. You will be amazed at how even a small change can have a big impact over time.

Would you like some help implementing these tips so you can own your home sooner? Give me a call today on 0428 162 602 or fill in the enquiry form here, to receive a free and no-obligation strategy session to find out how quickly you could own your home.